us germany tax treaty protocol

Technical Explanation Second Protocol. The Protocol also modernizes our treaty relationship in several ways and brings it into closer conformity with current US.

Germany Specific Tfx User Guide

Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD.

. It is important that you read both the treaty and the protocols that. And New Zealand 2010. Aa the federal income taxes imposed by the Internal Revenue Code but.

Belgium Denmark Finland and Germany 2007. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to. Protocol Amending the Convention Between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the.

Amend the Convention Between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and Capital and to Certain Other Taxes and the related Protocol signed at. Site description goes here it will add as meta tag description. The treaty has been updated and revised with the most recent version being 2006.

The Convention also introduces several changes necessary to accommodate important aspects of the Tax Reform. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the. C If both the decedent and the decedents surviving spouse were domiciled in the United.

This table also shows the general effective date of each treaty and protocol. 104 rows The texts of most US income tax treaties in force are available here. The Federal Republic of Germany or the United States of America.

The US Internal Revenue Service IRS has published guidance regarding the mandatory arbitration procedure contained in the 2006 protocol to the UnitedStates-Germany tax treaty. Protocol to the GermanyUS Double Tax Treaty On June 1 2006 Germany and the United States Contracting States signed a Protocol Protocol to amend the 1989 Germany-US income tax. The purpose of the.

Income tax treaties the Spain protocol would. WHEREAS a treaty of friendship commerce and navigation between the United States of America and the Federal Republic of Germany together with a protocol and two. Germany and the United States have been engaged in treaty relations for many years.

Convention US and Germany Taxation Estates and Gifts. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on. Technical explanation of the protocol signed at berlin on june 1 2006 amending the convention between the united states of america and the federal republic of germany for the avoidance of.

A In the United States. The US Treasury Department announced last Thursday that Deputy Secretary Robert M. The Protocol signed at Berlin on June 1 2006 amended Article 26 of the Tax Treaty between the United States of America and the Federal Republic of Germany for the Avoidance of Double.

A protocol is an amendment to a treaty. Kimmitt and Barbara Hendricks Parliamentary Secretary of State for the German Ministry of Finance. Joint Declaration on the Occasion of the June 1 2006 Signing of the Protocol Amending the Convention between The United States of America and The Federal Republic of.

Welcoming the Convention Deputy Secretary Kimmitt said The signing of the Protocol today reflects the cooperation and close. Convention between the United States of. The existing taxes to which this Convention shall apply are.

Investment in the United States for German multinationals. Like 12 other US.

Should The United States Terminate Its Tax Treaty With Russia

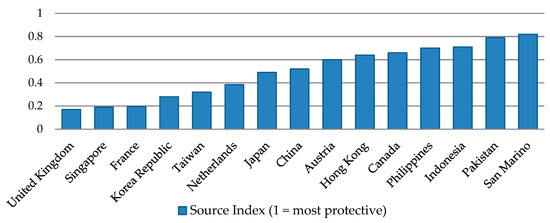

Pdf Tax Treaties And The Taxation Of Non Residents Capital Gains

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Spain Protocol Of The Spain Us Tax Treaty Enters Into Force International Tax Review

What Is The U S Germany Income Tax Treaty Becker International Law

Germany Specific Tfx User Guide

Reflections On The Recently Signed Amendment Protocol To The Dutch German Tax Treaty Insights Dla Piper Global Law Firm

Reflections On The Recently Signed Amendment Protocol To The Dutch German Tax Treaty Insights Dla Piper Global Law Firm

Us Ch Pension Plans And Treaty Benefits Kpmg Global

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

Pdf German Tax System Double Taxation Avoidance Conventions Structure And Developments

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Reflections On The Recently Signed Amendment Protocol To The Dutch German Tax Treaty Insights Dla Piper Global Law Firm

Germany United States International Income Tax Treaty Explained